Introduction

In today’s fast-paced digital world, businesses rely on merchant accounts to process payments efficiently. However, not all businesses qualify for standard merchant accounts. Some fall under the high-risk merchant category due to the nature of their industry, high chargeback rates, or regulatory concerns. If you're running a business that has been labeled as high-risk, understanding the nuances of a high-risk merchant account is crucial.

In this comprehensive guide, we’ll discuss what high-risk merchant accounts are, why businesses get classified as high-risk, and how to choose the best high-risk payment processor for your needs.

What is a High-Risk Merchant Account?

A high-risk merchant account is a type of payment processing account designed for businesses that are deemed to have a higher risk of fraud, chargebacks, or regulatory scrutiny. These accounts allow businesses to accept credit card transactions while managing the associated risks effectively.

Unlike standard merchant accounts, high-risk accounts often come with higher processing fees, stricter contracts, and rolling reserves. These measures are put in place by banks and payment processors to mitigate financial losses from fraud or disputes.

Why is a Business Considered High-Risk?

There are several reasons why a business may be classified as high-risk. Some common factors include:

- Industry Type: Businesses in industries such as gambling, adult entertainment, pharmaceuticals, and travel are often labeled high-risk due to legal complexities and higher chargeback rates.

- Chargeback Ratio: A business with frequent chargebacks (disputed transactions) may be considered high-risk.

- Subscription-Based Models: Businesses that offer recurring billing services can be viewed as high-risk since customers may dispute charges over time.

- International Transactions: Businesses processing payments from multiple countries are at higher risk of fraud and regulatory issues.

- Bad Credit History: Merchants with poor credit scores or a history of financial instability are often classified as high-risk.

Key Features of High-Risk Merchant Accounts

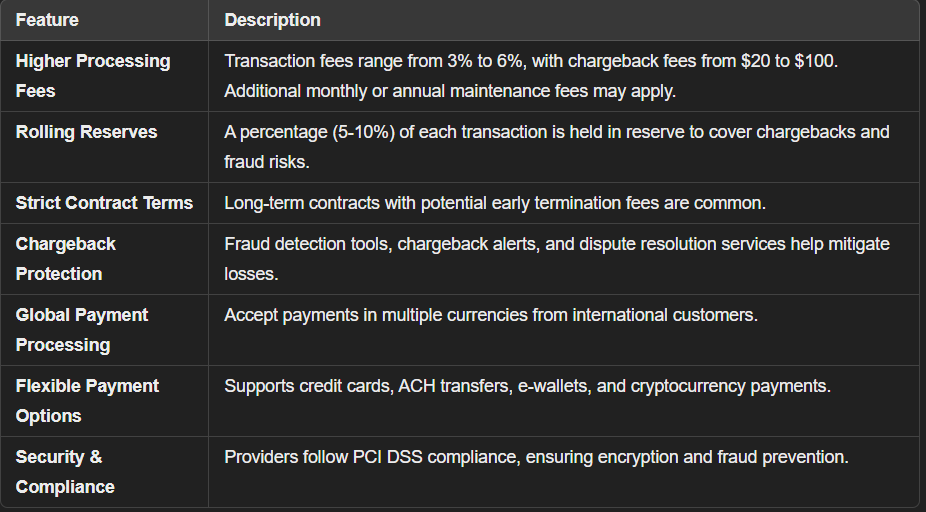

If your business falls into the high-risk category, here’s what you can expect from a high-risk merchant account:

1. Higher Processing Fees

Since high-risk businesses pose a greater financial threat, payment processors charge higher transaction fees to cover potential risks. Typical fees include:

- Transaction fees: 3% to 6%

- Chargeback fees: $20 to $100 per chargeback

- Monthly or annual account maintenance fees

2. Rolling Reserves

High-risk merchants are often required to maintain a rolling reserve, where a percentage of each transaction (e.g., 5-10%) is held in reserve for a set period to cover potential chargebacks or fraudulent transactions.

3. Strict Contract Terms

High-risk merchants may have long-term contracts with early termination fees, making it important to review terms before signing up with a provider.

4. Chargeback Protection

Since chargebacks are a major concern for high-risk businesses, many high-risk payment processors offer fraud detection tools, chargeback alerts, and dispute resolution support.

Related Read: Understanding Merchant Account Fees

How to Choose the Best High-Risk Merchant Account Provider

1. Look for Industry Experience

Choose a provider that specializes in high-risk businesses. They will have better fraud prevention tools and a deeper understanding of your industry's challenges.

2. Compare Fees and Terms

Different payment processors charge different rates. Compare transaction fees, chargeback fees, and rolling reserve policies before committing.

3. Check Payment Processing Options

Make sure the provider supports multiple payment methods, including credit cards, ACH transfers, e-wallets, and cryptocurrency payments.

4. Ensure PCI Compliance and Security

Security is critical in high-risk industries. Look for PCI DSS-compliant processors with strong encryption and fraud protection measures.

5. Customer Support and Reputation

Choose a processor with 24/7 customer support and positive reviews from other high-risk merchants.

Benefits of a High-Risk Merchant Account

Despite the challenges, a high-risk merchant account offers significant benefits:

- Global Payment Processing: Accept payments from customers worldwide.

- Higher Chargeback Tolerance: Unlike traditional accounts, high-risk merchant accounts are designed to handle more chargebacks.

- Flexible Payment Options: Support for alternative payments like cryptocurrency and digital wallets.

- Increased Revenue Potential: Accepting multiple forms of payment can help scale your business.

Common Industries That Require a High-Risk Merchant Account

- Online gaming and gambling

- Adult entertainment

- CBD and cannabis-related businesses

- Travel and ticketing agencies

- Subscription-based services

- Forex and cryptocurrency trading

- Debt collection and financial services

Conclusion

Operating a high-risk business doesn’t mean you can’t accept online payments. A high-risk merchant account is specifically designed to meet the needs of businesses with increased risks. By choosing a reputable high-risk payment processor, understanding fees, and implementing fraud prevention measures, you can successfully manage transactions and grow your business.

If your business has been labeled high-risk, explore different high-risk merchant account providers to find the best fit for your needs. With the right account, you can continue operating securely and efficiently.

FAQs About High-Risk Merchant Accounts

1. Can I Get a High-Risk Merchant Account with Bad Credit?

Yes, many providers offer high-risk merchant accounts even if you have bad credit, but expect higher fees and rolling reserves.

2. What is the Difference Between a Standard and High-Risk Merchant Account?

A standard merchant account is for businesses with low chargeback rates and minimal risks, while a high-risk merchant account is for businesses prone to chargebacks, fraud, or regulatory scrutiny.

3. How Can I Reduce Chargebacks for My High-Risk Business?

Implement fraud detection tools, provide excellent customer service, clearly outline refund policies, and use chargeback alerts to dispute transactions.

4. How Long Does It Take to Get Approved for a High-Risk Merchant Account?

Approval times vary, but most providers take anywhere from 24 hours to a few weeks, depending on the business type and risk level.

5. Do High-Risk Merchant Accounts Support International Payments?

Yes, many high-risk processors support global transactions and multi-currency payments, making it easier to do business internationally.

By understanding the essentials of high-risk merchant accounts, you can make informed decisions and choose the best payment processor for your business.

Stay ahead in the financial technology landscape with expert insights and advice. For further information, check out TheFinRate for extensive fintech resources and reviews!